When you think about financial education, what first comes to mind? For most people, it’s things like budgeting, debt ratios, savings accounts — the numbers.

But at Catapult®, the numbers are only part of the story.

Before any discussion of income or expenses, we want to know your story — the story you tell yourself about money, the one that shaped how you handle it, and the one you’re still writing about your future.

Because at the end of the day, all the spreadsheets and knowledge in the world won’t make a difference if a limiting mindset is standing in the way.

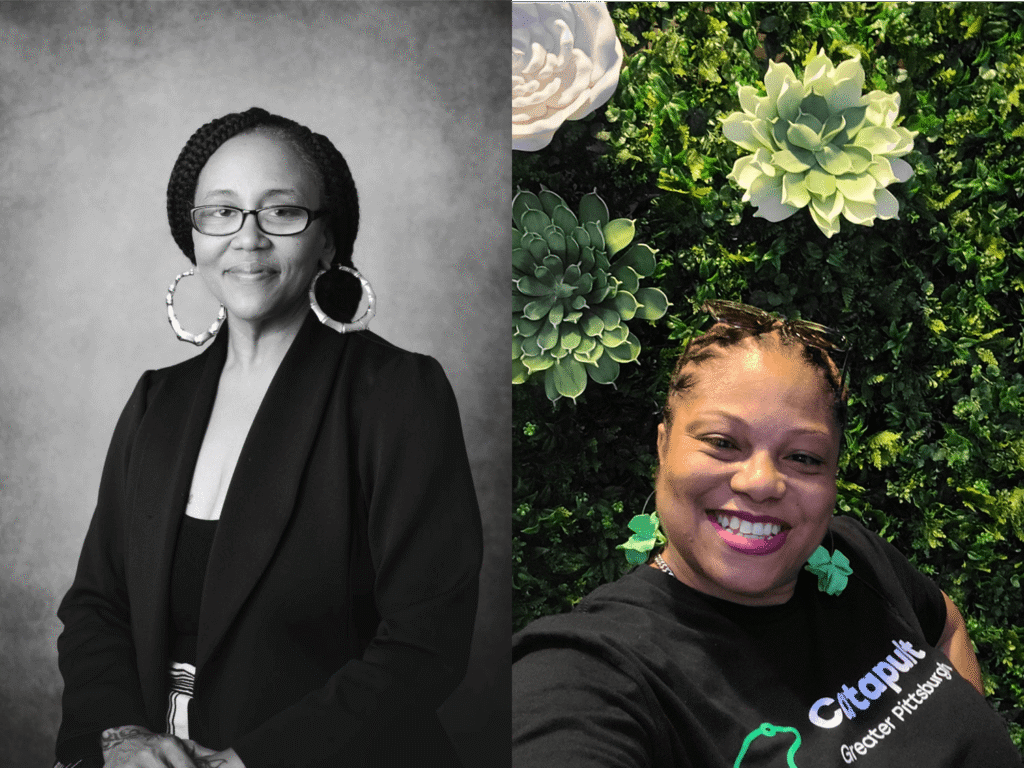

No one understands that better than Catapult Financial Education Counselors Aisha Gunter and Princess Shavers. Through our S.A.V.E. program, they provide one-on-one trauma-informed guidance that goes beyond financial principles to address the deeper roots of generational poverty.

With compassion, clarity, and a unique ability to meet people where they are, Gunter and Shavers help participants uncover the “why” behind their financial habits so that they can make lasting, cycle-breaking change.

We sat down with both counselors to learn more about their journeys, what financial counseling looks like at Catapult, and how they’re helping people rewrite their money stories.

A Q&A with Catapult® Financial Education Counselor, Aisha Gunter

Where are you from, and how did you find your way into financial counseling?

I’m originally from the Pittsburgh area. My degree is in the music business, but before Catapult, I taught special education for four years and then worked as a flight attendant for 16 years. During the height of the pandemic, I wanted to do something more community-based and impactful, which led me to seek out work in the social and nonprofit space. I knew two women who worked at Catapult, heard about their experience, and thought I could be an asset. I joined the team in January.

As a financial counselor, I help Catapult clients address anything that may have stopped them from becoming homeowners, as right now, most of my counseling is geared toward first-time homebuyers. We look at what habits to keep, what to tweak, and how to be good stewards of a home.

What’s the biggest challenge you see clients facing?

Self-doubt. When society labels you as an “eternal renter,” it’s easy to believe that. Yes, we address credit scores and budgeting — those things are important — but once someone believes they can do it, they’re halfway there. My participants first have to see saving and homeownership not as some big scary monster, but just as something they are not used to.

How do you help people move past those doubts?

By pairing mindset shifts with practical steps. We start by exploring where their beliefs come from and then focus on how to reframe them. Once their mindset changes, we align it with tangible actions, such as setting savings goals or creating a strategy to reduce debt. Sometimes people just need to see the numbers in black and white and have someone who holds them accountable. The key is to break big goals into smaller, digestible pieces — or as I say, “eat the elephant one piece at a time.”

Are there any memorable success stories that stick out to you?

To me, every time someone circles back just to say “thank you” — that’s a success. Whether or not they buy a home through our program, I’m thrilled if they’ve gained knowledge they’ll use moving forward.

How are you advising people in today’s tough economic climate?

There are a lot of unknowns right now. I’m honest about that with my clients and focus on encouragement and building savings. Now, more than ever, is the time to buckle down and get your emergency fund to a place where, if something happens, the rug doesn’t feel ripped out from under you.

Who is Catapult’s financial counseling for, and what would you say to someone considering it?

Our counseling is for anyone who wants to take a closer look at their relationship with money. Historically, we’ve focused on supporting people who’ve had circumstances stacked against them, but it’s truly open to all. I’d tell anyone thinking about it to come with an open mind. This is not your traditional financial counseling — it’s transparent, trauma-informed, and tailored to you. We’ll talk about your goals, yes, but we’ll also talk about your childhood experiences with money and the emotions that shape your choices today. It’s not about judgment; it’s about understanding the full picture so we can help you create real, lasting change.

A Q&A with Catapult® Financial Education Counselor, Princess Shavers

What’s your background, and what led you to Catapult?

My background is in criminal justice. I did a lot of nonprofit work with POWER (Pennsylvania Organization for Women in Early Recovery), working in a halfway house, chairing the anti-racism task force, updating policies, and leading trainings. Eventually, it became too emotionally heavy for me to keep working in that setting. A former POWER colleague, Nissa’a Stallworth, told me how wonderful Catapult was — how they offer the space to grow and feel safe — so I applied. I interviewed for an executive assistant role, but they invited me to consider a Financial Education Counselor position, and I joined the team in January.

How does your background prepare you for this role?

A lot of this work is literal counseling. People are going through life and facing struggles; sometimes we don’t even talk numbers at first. They may log on to the call and cry — it’s bigger than just giving them information about their finances. Of course, that’s a huge part of it, but a lot of it is also about being a support to them, and I have plenty of background there, from dealing with case management to understanding and meeting people where they’re at. That’s a big part of what we do.

Would you say that the psychological or mindset component is often the biggest challenge for people?

Absolutely. People come from backgrounds where they’ve experienced things like poverty or homelessness, and those experiences carry into adulthood. Until you acknowledge what you’ve gone through, it’s hard to move forward. I help people unlearn beliefs from childhood and redefine success based on what they have now and what they can gain in the future.

It’s a tough time now for a lot of people economically. How do you help people start saving when budgets are tight?

I always teach people to “pay yourself first.” Treat your savings like an essential bill, just like rent or electric. When money comes in, a set amount goes to you first. And once it’s “paid,” you don’t take it back — just like you can’t call the utility company to ask for your payment back. That shift can help people save even when the economy feels like it’s failing us.

Can you think of a memorable success story of someone you’ve helped in your time with Catapult?

There was one participant who started with a credit score in the 400s. Through follow-ups, encouragement, setting money aside, and tackling debt one bill at a time, she raised it to the mid-600s — enough to qualify for our RNIH program. Helping her make that progress was a truly rewarding experience.

Since March, I’ve also been meeting with participants in Catapult’s entrepreneurship programs. I help them unpack their money beliefs, track their spending, review their credit, and create an action plan. A common challenge I see entrepreneurs dealing with is mixing personal and business finances. I help them separate and manage each strategically so they can build a strong foundation from which to grow their businesses.

How do you keep people motivated when they face challenges?

Through active listening and positive affirmation. Often people already have the answers — they just need space to talk or cry it out and someone to reflect back their capacity, someone to tell them, “Hey, you can save, invest, and grow.” Once you know why you spend the way you do, you can start changing it.

What’s surprised you about working at Catapult?

The family-like atmosphere. Catapult truly practices what it preaches. I feel supported and valued, and I’m focused on growing in this role — becoming the best counselor I can be.